As a nonprofit professional, you might not realize just how much accounting affects your organization’s daily activities. When you think of accounting, the image that comes to mind may (understandably) be of a serious financial professional crunching numbers in a spreadsheet or filling out tax forms for an individual or business—not of a critical process that your organization needs to prioritize.

In reality, accounting affects every aspect of your nonprofit’s work, from management to fundraising to service delivery. None of those activities would be possible without revenue, which needs to be properly tracked and allocated so you can cover all of the necessary costs to further your mission.

No matter what position you hold at your organization, it’s helpful to understand some of the basics of nonprofit accounting. In this guide, we’ll walk through three core aspects you should be familiar with, including:

- The Difference Between For-Profit & Nonprofit Accounting

- Nonprofit Accounting & Financial Roles

- Key Nonprofit Accounting Resources

Remember that every organization is different, so your nonprofit’s approach to accounting will vary based on its size, needs, and mission. Let’s get started by reviewing what accounting is and why it’s important for nonprofits in particular.

1. The Difference Between For-Profit & Nonprofit Accounting

According to Jitasa, accounting refers to the process by which organizations “plan, analyze, and report their financial activities.” Both for-profit and nonprofit organizations use accounting, but the main focus and processes differ between the two.

For-profit organizations’ accounting systems function around the goal of maximizing profit. They record and analyze their transactions to assess business performance, forecast income from the sale of goods or services, and keep production costs in check. They also use their accounting information in the management of relationships with investors or shareholders if they’re publicly traded.

Nonprofits can’t turn a profit by definition and instead have to reinvest all of their funding into the organization. Therefore, nonprofits focus mostly on the accountability side of accounting. Tracking and reporting financial information allows organizations like yours to comply with government regulations for nonprofits, make data-driven decisions about allocating funding, and be transparent with donors about how you’re using their contributions to further your mission.

2. Nonprofit Accounting & Financial Roles

If your nonprofit is small to mid-sized, your first goal should be to have three people in charge of managing its finances. As your organization expands, you may need to bring more individuals on board to create an entire finance team or department. However, starting with at least three helps ensure accuracy (so different individuals can check each other’s work) and effective distribution of duties.

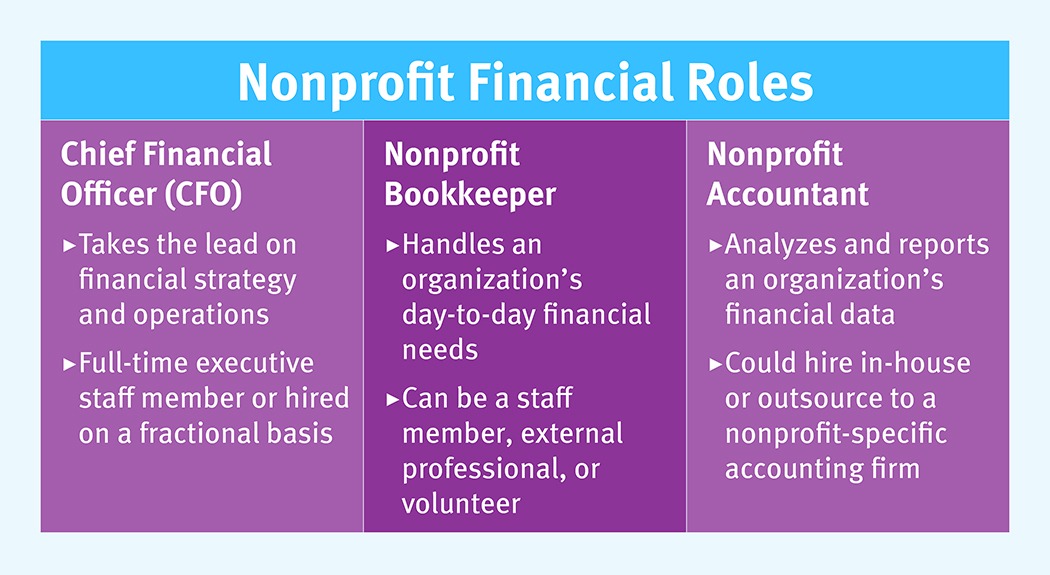

The three roles your nonprofit’s financial professionals will initially fill are:

- Chief financial officer (CFO). This individual takes the lead on various aspects of financial strategy at your organization, including budgeting, cash flow forecasting, and implementing policies that guide your nonprofit’s use of funds. They can either be a full-time member of your executive leadership team or hired on a part-time (fractional) basis from an outside organization.

- Bookkeeper. Your nonprofit’s bookkeeper takes care of its day-to-day financial needs, such as writing checks, making bank deposits, and recording transactions. Although bookkeeping requires some training to do properly, bookkeepers don’t need specialized education or certifications. So, this role could be filled by any staff member who has financial knowledge, an external professional, or even a trusted volunteer.

- Accountant. Nonprofit accountants are in charge of analyzing and reporting your organization’s financial information in a variety of ways, from filing tax returns to preparing for audits to making actionable recommendations for improving your use of funds. Because hiring a full-time accountant with at least a bachelor’s degree and a CPA certification can be expensive, many organizations instead look into options for outsourced accounting for nonprofits.

Although the majority of your organization’s financial responsibilities will fall to these three individuals (and the other members of your finance team if you create one), it’s still important for all other nonprofit professionals to understand what they do. That way, you can effectively communicate with these professionals and apply the data they work with to your daily activities.

3. Key Nonprofit Accounting Resources

In addition to the duties of your nonprofit’s financial professionals, there are some finance-related resources you should be familiar with no matter what your role is at your organization. These types of accounting documentation touch the entire nonprofit’s operations, so you’ll likely encounter them at one time or another and should know what they entail.

The key accounting resources you should understand include your organization’s:

- Transaction records. This is where all of the donations, grants, and other revenue you receive are recorded, as well as all of your organization’s expenditures. Although many organizations start out tracking their transactions in a spreadsheet, OneCause’s nonprofit software guide recommends adding a dedicated accounting solution to your data management and operations toolkit for increased efficiency.

- Operating budget. This document is the master financial plan that lays out all of your organization’s spending and income generation for a given fiscal year. It first breaks down your expected revenue by source so you can fundraise, invest, and seek grants more effectively. Then, it organizes your predicted expenses into the categories of program-related spending and overhead so you know how much of your funding will be used for mission-centered work versus daily operations.

- Financial statements. These reports organize key financial data in different ways so that you can glean actionable insights from them. The statements of activities and functional expenses are helpful for budgeting, the statement of cash flows helps you stay on track with spending and fundraising throughout the year, and the balance sheet demonstrates your organization’s financial health.

- Tax forms. Just because your nonprofit is exempt from paying federal income taxes doesn’t mean you can completely write off tax season! You still have to complete an annual tax return, known as Form 990, to demonstrate to the IRS that your organization is maintaining compliance with nonprofit regulations. Plus, as an employer, your organization needs to issue W-2s and 1099s to your employees and contractors respectively to help them file their individual taxes each year.

As stated previously, your nonprofit’s financial professionals will be in charge of compiling each of these documents—the bookkeeper is responsible for the transaction records, the CFO for the budget, and the accountant for the financial statements and tax forms.

However, various nonprofit roles are involved in applying and communicating about these documents. For example, the development director will need to review the balance sheet to decide if the organization is in a good place to expand, and the fundraising committee will compare campaign data to the budget to determine if their initiatives succeeded.

Although nonprofit accounting may seem complicated at first glance, it’s more accessible and applicable than you might think. Familiarize yourself with the resources that will be most helpful to your work for your organization, and don’t hesitate to ask any questions you might have as you consider how you can make the best use of funds to further your mission.