Nonprofit donation processing is an often overlooked aspect of strategic fundraising. It’s frequently seen as a background technical process that happens automatically. In actuality, donation processing is the fundamental process that allows your organization to accept the money you raise online.

It’s important for nonprofits to understand donation processing because it fuels your online fundraising efforts and empowers you to accept all types of payments from supporters. This includes donations, event tickets, membership fees, merchandise sales, and other transactions.

When you fully understand donation processing and the tools that make accepting donations possible, you can discover areas for improving your organization’s own process. With this foundational knowledge, you can create stronger fundraising strategies that optimize your use of payment processors.

This guide will address the fundamentals of donation processing:

- What is nonprofit donation processing?

- What’s the difference between payment processors and online donation platforms?

- How can donation processing tools benefit your nonprofit?

- What should you look for in online donation software?

We’ll cover the basics of digital donation processors as well as the overarching fundraising platforms organizations can use to optimize their payment processing systems. Think about your organization’s current process and how you can improve it as we explore this information.

What is nonprofit donation processing?

Nonprofit donation processing is the process of reading and confirming donors’ financial information when they make online transactions. It’s the back-end process that donors trigger when they first submit their donation form and ends when their gift is deposited into your organization’s account.

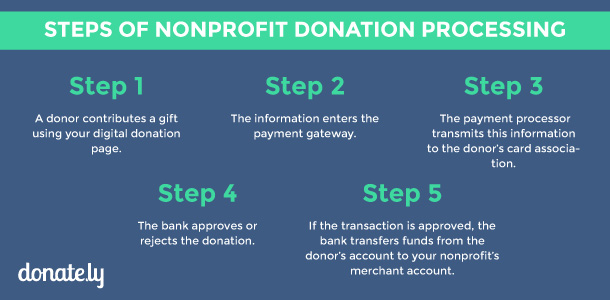

Here’s how Donately’s guide to nonprofit donation processing defines the steps of the donation processing process:

- A donor contributes a gift using your digital donation page. They may use a credit/debit card or an eCheck to do so.

- The information enters the payment gateway. The payment gateway is a fraud prevention procedure that your payment processor completes to protect donors’ financial information.

- The payment processor transmits this information to the donor’s card association. A card association is an organization that issues credit or debit cards to cardholders, such as MasterCard or American Express. The card association notifies the donor’s bank about the transaction.

- The bank approves or rejects the donation based on the donor’s available funds in their account or credit limit. The bank sends this information back to the card association, which communicates it to your organization.

- If the transaction is approved, the bank transfers funds from the donor’s account to your nonprofit’s merchant account. Your merchant account is your bank account that’s configured to accept online donations.

This may seem like a complicated process with a lot of moving parts, but it moves very quickly and you can easily simplify it by using the right tools. We’ll go into more detail about what kind of tools you’ll need to optimize the process.

What’s the difference between payment processors and online donation platforms?

While the two often intersect, your organization’s payment processor is a different tool than your online donation platform.

Your payment processor is the background tool that safely communicates your donors’ information and harnesses their contributions for your organization’s use. Your online donation platform, on the other hand, is a supporter-facing tool used to collect donations. You can use this tool to create a website page where donors can make a gift directly on the page without any added steps.

The best online donation platforms offer integrations with secure payment processors to simplify the gift collection process for both nonprofits and donors.

This way, you can create customized, branded donation pages that your supporters trust, and they’ll seamlessly integrate with quality payment processors like Stripe or PayPal. You’ll also benefit from the legitimacy and professionalism of partnerships with these top payment processing organizations because donors will recognize and trust names like PayPal.

It’s important to note that you don’t have to invest in a donation platform to accept online gifts if you decide against it. You can use a payment processor by itself, such as PayPal or even Venmo. However, these platforms don’t allow you to create a customized donation page for your organization. Being directed to a generalized third-party page without your organization’s branding can drive supporters away and cause distrust regarding your donation form.

What can donation processing tools do for your nonprofit?

Nonprofits use payment processing tools to grow their fundraising potential and streamline the donation process for both staff and supporters. But what exactly do these tools empower nonprofits to accomplish? Along with accepting donations online, payment processing solutions allow your organization to:

- Handle donors’ sensitive information safely. With a donation processor, you can reassure donors that their financial information is safe thanks to an organized, formal process. This can boost your donor retention rates over time because donors will know your organization handles their information and contributions wisely.

- Encourage monthly giving. A payment processor makes it much easier to manage the collection of recurring donations by streamlining the process for donors. When donors don’t have to put in any added effort to give monthly recurring gifts, they’re much more likely to do so.

- Sell online merchandise. An online payment processor can facilitate selling branded merchandise, such as t-shirts, mugs, hats, or stickers, which can be an efficient fundraising method for your nonprofit.

- Sell event tickets. Whenever you host events, you need a way to sell and distribute tickets. Payment processors help facilitate these transactions quickly and easily to boost your attendance numbers and the funding that comes from ticket sales.

You’ll get all of these benefits if you choose to invest in an online donation platform that integrates with a secure payment processing system. In addition, you’ll be able to:

- Capture donor data to use to inform future fundraising strategies. Comprehensive online donation platforms can collect donor data such as names, contact information, home addresses, email addresses, and phone numbers. You can store these details in your nonprofit CRM to follow up with donors again and secure continuous support.

- Access additional fundraising features. Plenty of online donation platforms offer a suite of fundraising tools to support your fundraising strategies. In addition to online donation pages, your nonprofit can also gain access to text-to-give platforms and peer-to-peer campaigns. Then, you can promote these pages with social media integrations. These features help organizations drive online donor engagement in a comprehensive, multi-tiered strategy.

Without dedicated tools, conducting these activities becomes very difficult, if not entirely impossible. With online donation software that integrates with payment processing systems, you can easily carry out each of these functions through one convenient platform.

What should you look for in online donation software?

Using your knowledge of how donation processing works, you can start searching for the right online donation tools for your organization. As you research, there are several desirable features you should look for in any platform you consider. You’ll want your online fundraising platform to include the following features:

- Nonprofit-focused. When you invest in a tool designed specifically for nonprofits, you’ll ensure the features you gain access to are ready for the unique world of nonprofit organizations. For example, you’ll gain access to donation-specific forms while for-profit solutions might instead provide sales forms. You’ll also have a better customer service experience because your provider will understand common nonprofit needs and concerns.

- Multiple payment options. Make sure your fundraising platform supports integrations with top donation processors like PayPal and Stripe. This provides flexibility to find the right payment processor that aligns with your organization’s needs and makes it easy to set up the necessary software to collect gifts.

- User-friendly. Search for an online donation tool that offers intuitive functionality. This is especially important if your organization doesn’t have a dedicated digital team or IT department. Not having to dedicate time to solve technical difficulties allows you to immediately jump into designing your donation pages and accepting gifts.

- Low operating costs. Every online donation you accept will come with a processing fee. Payment processors charge different rates, so be mindful of your budget as you search. Donors are often happy to pay this fee themselves, so look for a processor that provides an option to pass the transaction fee to them.

- Fraud protection tools. These may include an address verification system, bank identification number checking, and IP blocking to prevent connections with harmful internet addresses. Each processor varies in its fraud protection tools, so be sure to research which tools they offer. Any processor you choose should be PCI-compliant.

- Ability to generate donor reports. To gather the valuable donor information we mentioned in the last section, you’ll want an online donation platform that generates detailed, organized donor reports.

Spend some time exploring resources like Re:Charity’s list of top donation software options to find the solution that’s right for you. There are tools for all types of organizations, from nonprofits to schools, churches, and more. Each platform varies in the tools it provides depending on the target organization, so keep your eyes peeled for the specific features your team needs.

You should have a better understanding of nonprofit donation processing and what it means for your organization’s fundraising efforts. By optimizing your online donation process, you can give more attention to all of your donations, which helps form a more comprehensive fundraising strategy. In turn, you’ll prove to donors that you value and prioritize keeping their online contributions safe.