Financial instability is a common challenge for nonprofits, and it’s among the top reasons for failure. Strong leadership over your organization’s financial activities and familiarity with them builds the foundation for fundraising, budgeting, and, ultimately, fulfilling your mission. As trustees of your organization’s assets, your board members need to understand financial governance to be one of their primary responsibilities.

Fiduciary duty refers to your board members’ obligation to act in the best interest of your nonprofit. This duty encompasses many financial tasks, which we’ll discuss in this guide.

1. Oversee Financial Administration

The duty of financial oversight requires board members to supervise the nonprofit’s overall financial performance to ensure effective usage of funds. This oversight helps maintain financial stability, compliance, and sustainability while serving as a check and balance on the organization’s senior leadership.

Financial oversight includes, but is not limited to:

- Approving the organization’s annual budget and reviewing it periodically

- Monitoring financial reports such as the Statement of Financial Position, the Statement of Activities, and the Budget vs Actual.

- Ensuring compliance with relevant laws and regulations.

Even if your nonprofit board has a dedicated finance committee, the entire board plays a role in financial oversight. For example, the full board must approve the annual budget and receive a financial update at each board meeting to ensure that spending aligns with revenue. The finance committee, however, may be far more involved in the details within the annual budget and the monthly financial statements. Nonprofit treasurers often spearhead finance committees and may serve as your organization’s main financial expert.

2. Participate in Fundraising

While fundraising is adjacent to financial management, it falls under board members’ fiduciary responsibilities because it impacts your nonprofit’s ability to fund programs and fulfill its mission. Therefore, board members have a duty to support the organization’s fundraising efforts by:

- Creating strategies: Board members should actively participate in developing fundraising plans and refining them based on past performance. Additionally, the board may select management, delegate tasks, and work closely with them to meet fundraising goals.

- Attracting resources: Board members can help your nonprofit expand its network through prospect identification, cultivation, and stewardship. They may even tap into their own social or professional networks to find new supporters for your organization.

- Monitoring techniques: Board members should evaluate your organization’s fundraising methods to ensure they’re effective and aligned with legal and ethical guidelines. These insights, along with data about your nonprofit’s budgeted and actual expenses, help board members determine whether your current fundraising strategy is successful.

Another crucial component of board members’ involvement in fundraising is their personal participation. After all, it only makes sense for your board members to fundraise on your nonprofit’s behalf if they’ve given to the organization.

3. Ensure Financial Accountability

As part of their financial oversight duty, board members must ensure your organization’s financial operations are accountable. This involves selecting the auditors and reviewing the results, ensuring compliance with federal and state nonprofit laws, and ensuring your organization’s spending aligns with mission objectives and donor restrictions.

To fulfill this responsibility, board members should be familiar with your nonprofit’s general accounting approach. According to the Chazin firm’s nonprofit accounting guide, understanding this process “equips every team member with the insight needed to make informed decisions that align with your financial goals.”

The best way to keep board members informed about financial practices is through regular financial reviews. Your nonprofit’s treasurer should have enough experience to lead these reviews and provide financial guidance where necessary. If you’re looking for more in-depth financial support, your nonprofit might also partner with a professional accountant.

4. Establish Internal Controls

Board members must work with nonprofit management to protect the organization from financial risk. Mitigating risk necessitates strong internal controls, which often starts with effective policies.

Key internal policies your board should enact include but are not limited to:

- Conflict of interest policy: A policy that helps organizations identify and address situations where an individual’s personal interests could interfere with their professional duties.

- Whistleblower policy: A policy that protects employees or individuals who report any unethical or unlawful practices or who report inappropriate behavior within an organization.

- Gift acceptance policy: A policy that outlines the rules and guidelines an organization must follow when accepting gifts, donations, or other types of contributions. The policy is designed to ensure that gifts are consistent with the organization’s values, goals, and legal requirements.

- Dual authorization policy: A policy that requires two layers of approval for expenditures over an amount determined by the board.

After establishing these policies, training board members (especially new ones) on fiduciary responsibility, including the policies, is crucial. Incorporate these into your orientation materials to ensure board members are familiar with relevant guidelines from the beginning of their term. Additionally, the policies should be easily accessible in case board members need to revisit them in the future.

5. Uphold Fiduciary Responsibility and Ethical Leadership

As mentioned earlier, fiduciary responsibilities require board members to act in your nonprofit’s best interest at all times. This means board members must demonstrate ethical decision-making and leadership, especially as governed by federal and state laws.

To uphold their fiduciary duties, board members must make well-informed financial decisions and place the nonprofit’s interests ahead of their personal gain. Above all, they should ensure all financial activities adhere to best practices and advance the nonprofit’s mission and values.

Keep in mind that not all board members come to your organization with vast experience in financial management. However, all board members need a basic level of financial literacy to understand the data presented to them and determine the organization’s financial health.

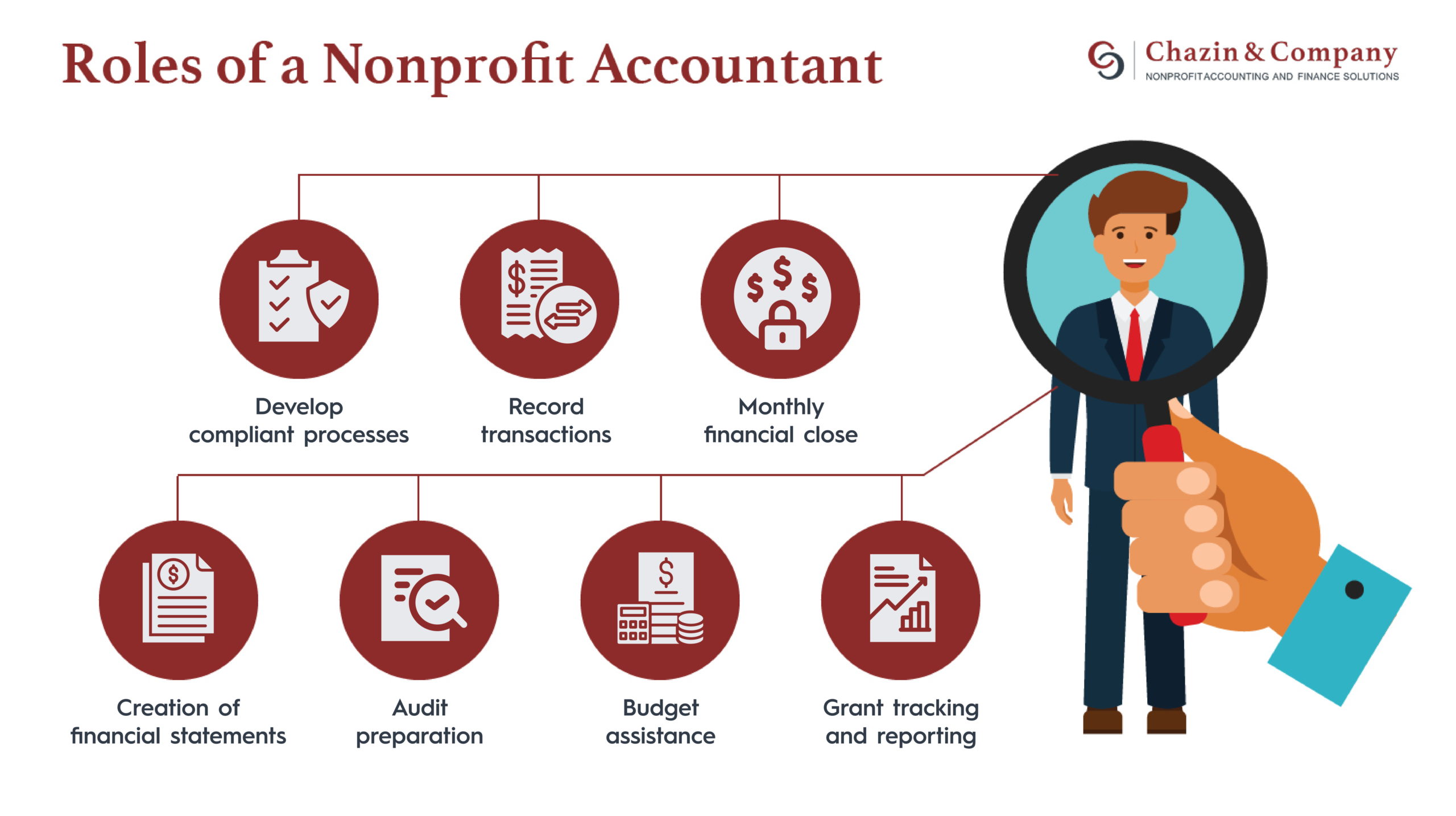

For further guidance on maintaining accurate, compliant, and strong financial efforts, board members can always seek professional nonprofit accounting services:

- Developing compliant processes

- Recording transactions

- Monthly financial close

- Creating financial statements

- Audit preparation

- Budget assistance

- Grant tracking and reporting

Board members should be highly involved in choosing an external accountant. If you choose to outsource your accounting needs, ensure the candidates mesh well with your board members and can cater to your board’s workflows. For example, consider their procedures surrounding budget assistance—will the firm’s accountants review the budget with you on a monthly or quarterly basis?

Board members can only fulfill their financial duties when they fully understand your organization’s expectations and financial needs. Make sure their responsibilities are clearly laid out, and provide necessary context about your nonprofit’s fundraising capacity to help them understand its financial strengths and areas for improvement. This way, board members will be well-equipped to help your nonprofit achieve its goals.