All nonprofit leaders aim to grow and expand their organizations to better fulfill their missions. For leaders of smaller organizations, this might mean diversifying their programming or opening a second location in the neighboring community. At the mid-size and enterprise levels, nonprofits also often consider venturing across the country to start fundraising in multiple states. Our guest author Dr. Steven Urich makes a strong case for understanding this strategic concept, another brilliant way to improve the productivity of your fundraising efforts.

However, before a nonprofit’s fundraising team can start collecting donations in their new state, they’ll need to ensure they are in compliance with state legal requirements for soliciting donations. Nearly every state in the U.S. has charitable solicitation laws to ensure donations are collected only by registered, reputable nonprofit organizations that adhere to their state’s specific regulations.

To help your nonprofit’s team complete your charitable solicitation registration process to start fundraising in multiple states, this article will provide an FAQ on common questions about registering for multi-state fundraising, before then walking through the registration process.

While there are many steps your nonprofit’s team can complete on their own, the process can get quite complicated and is often protracted over the course of several months. The number of documents required to complete your charitable solicitation registration and the lengthy time frame can result in important items falling through the cracks. Fortunately, this can be avoided with assistance from compliance consulting services that specialize in nonprofit registration.

Multi-State Fundraising FAQ

Registering to fundraise in multiple states can require extensive research, both into general best practices your organization’s staff should adhere to and the specifics of each registration application you intend to file.

To help your nonprofit’s team start the registration process off with a strong, foundational knowledge of what to expect, this FAQ will cover three commonly asked questions.

Who do I need to file with to solicit donations in multiple states?

Charitable solicitation registrations are handled on a state-by-state basis. While some states might have similar procedures, most states differ just enough in their requirements that nonprofits should conduct diligent research for each jurisdiction where they’ll be filing.

These differing and unique requirements also mean that your charitable solicitation registration may be done through different state charity bureaus, which are usually managed by either the Secretary of State or State Attorney General. This means you’ll need to double check who should receive your forms when submitting your application, as well. Additionally, because state charity bureaus are managed by different government agencies, you’ll find information about what you need to register on different government websites for many states.

This may sound complex, but don’t let these warnings discourage you from expanding your operation and bringing value to even more supporters. It just means you’ll need to schedule research time into your registration process and double check your information as needed.

Do I need to wait for my registration before soliciting donations?

Yes, your nonprofit should have your charitable solicitation registration application approved before soliciting donations. Due to the length of the process, it may seem more efficient to start fundraising concurrently with your application process, but doing so can result in a range of legal penalties to your nonprofit.

Common penalties for soliciting donations without registering with the relevant jurisdiction include:

- Fines and late fees

- Revocation of tax-exempt status

- Lost donations or grants

- Potential civil or criminal charges against officers and directors at your nonprofit

Additionally, getting caught soliciting donations without registering can severely impact your nonprofit’s reputation long-term. Some states such as California, Pennsylvania, and Virginia even publicly publish lists of nonprofits who have violated charitable solicitation registration laws, ensuring your supporters know about the failure to comply with state law.

Do I need to file a Unified Registration Statement to solicit donations in multiple states?

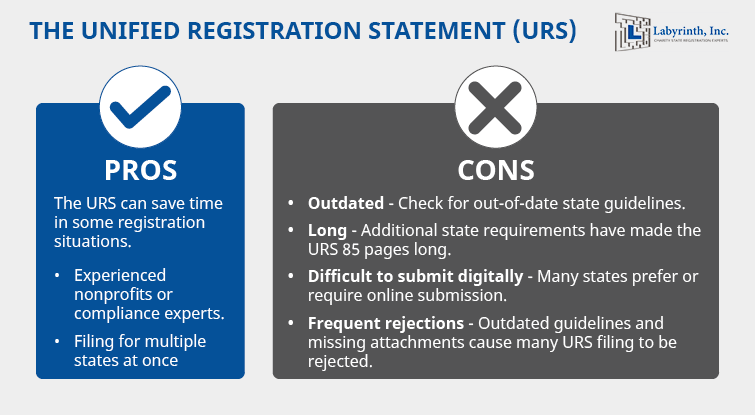

If you’ve heard of the Unified Registration Statement (URS), it might sound like the perfect solution for applying to solicit donations in multiple states at one time. The URS was created for this purpose in an attempt to compile every states’ charitable solicitation registration requirements into one document, making registering much easier and faster for nonprofits.

However, the URS has certain challenges that actually make it easier for nonprofits to register in each state individually. Labyrinth’s guide on the Unified Registration Statement goes into extensive detail on this topic and outlines the benefits and challenges of filing the URS:

Pros

The URS was created to save nonprofits time, and when used correctly, it can still accomplish that for select organizations. However, often only highly experienced nonprofits and compliance experts will be able to correctly leverage the URS to save time and have multiple state filings approved at once.

Cons

If your nonprofit’s team has limited experience with these types of documents and registration processes, the URS may waste more time than it saves. While it may still be usable in specific circumstances and with dedicated research, it comes with several drawbacks, including:

- Outdated information. While some changes were made in 2014, the URS has not seen significant updates in over ten years. This means much of the information on the URS is not reliable, and nonprofit professionals will need to conduct additional research to find the correct information.

- Lengthy forms. Satisfying multiple state registration requirements at once means that you’ll need to fill out several forms. Currently, the URS is 85 pages long and requires extensive time and effort to complete.

- Issues with online filing. The URS is a physical document, and most states prefer or require charitable solicitation registration applications to be submitted digitally.

- Numerous rejections. The biggest drawback of the URS is that due to its outdated information and requirements, nonprofit directors who do manage to complete the URS still have a high chance of getting their application rejected. Plus, different states have different renewal requirements and timeframes, making the URS an impractical tool for maintaining your registration.

Ultimately, if you are aiming to expand your nonprofit’s fundraising efforts into one or two additional states, you’ll likely have an easier, faster time filling out individual charitable solicitation registration forms.

How to Register for Charitable Solicitations in Multiple States

Once your team commits to expanding your fundraising operations into multiple states, you’ll need to prepare for a multi-step application process that can take several months. For nonprofit leaders new to registering in multiple states, you’ll generally need to follow a three step process:

1. Research the requirements of your target states.

As mentioned, different states have different requirements, including what forms to submit, how to submit your forms, and where to look for information on what forms to submit.

Additionally, charitable solicitation registration requirements are subject to change at any time, and nonprofits should check-in on their target states’ application details while applying. This also means that some components of the form you submitted when you first applied may not be accepted for future renewals.

2. Prepare necessary documents.

While state requirements differ, there are common documents that many states require as part of their registration process. These materials can include:

- IRS Form 990. Your Form 990 is the annual financial reporting document that must be submitted to the IRS to maintain IRS tax-exempt status.

- Nonprofit Bylaws. Your nonprofit’s bylaws explain how your organization is run and procedures your organization must follow such as officer responsibilities, board voting procedures, and requirements for official meetings.

- Nonprofit Articles of Incorporation. Your Articles of Incorporation are a governing document for your organization along with your bylaws. It includes core information such as your nonprofit’s name, location, purpose, and initial directors.

- IRS Letter of Determination. Your Letter of Determination is an official letter from the IRS confirming your nonprofit’s tax-exempt status.

- List of Officers, Directors, and Trustees. Provide a list of your officers, directors, and trustees’ names, addresses, and titles at your nonprofit.

- Reviewed and Audited Financial Statements. Audit or review your financial statements based on your target states’ requirements. For most states, you’ll need to provide documentation of your total revenue received during the fiscal year, total contributions received during the fiscal year, and any state or federal grants you have received. You’ll likely need to work with a professional nonprofit accountant to produce these types of financial documents if they’re required.

- Contracts with Fundraising Counsel, Solicitors, and Consultants. If your nonprofit works with external contract partners such as consultants or professional solicitors, you’ll need to submit copies of your fundraising contracts.

- State Specific Forms. Individual states will likely have their own, unique forms that you’ll need to fill out to complete your application.

While these legal requirements may seem extensive or even overwhelming, keep in mind that states have stringent charitable solicitation registration requirements for a reason. By ensuring that only reputable organizations are able to solicit donations, your supporters will have greater trust in your nonprofit when making a donation.

3. Submit forms for registration and wait for approval.

Before submitting your registration forms, double check all of your prepared materials against your state requirements. Then, confirm which state office you’ll need to submit your application and complete any necessary online tasks to finish the process.

After submitting your form, you’ll need to wait for approval before you can start fundraising. Given the length and complexity of the submission process, many nonprofit officials find it helpful to partner with a compliance consultant. Resources like Double the Donation’s recommended nonprofit consulting firms that specialize in nonprofit registration and legal compliance. These consultants provide services that include handling the registration process for your organization and conducting necessary follow-up on your behalf through the appropriate channels.

Multi-state fundraising allows you to further your mission in new and exciting ways by gaining access to supporters who were formerly out of physical reach. To get started, make sure to complete the charitable solicitation registration process. Conduct research on state compliance regulations, prepare key forms for your application and look into services that can assist your nonprofit at any stage of the process.